It used to be that the most high-tech piece of equipment on a construction or building site might have been the back hoe or front-end loader. As Bob Dylan once sang, the times they are a changin' . . . today's residential and non-residential construction sites are employing innovative new technologies and ideas to make projects stronger, safer and smarter.

Equipment Leasing & Finance Foundation recently released their 2018-2019 Vertical Market Series Report on the Construction Market and although the construction market is not as simple as whether you're building your residential, non-residential or non-building structure with sticks or concrete, some of the same trends and ideals came through: build smartly, be innovative, and make the right investments.

Before we dive into specifics to the construction market by segment, first let's look at the overall macroeconomic environment and how it relates to construction. As we pointed out in our April 2018 blog, State of the Small Business – Optimism on Economy Remains Strong, economic confidence was bright for 2018 and small business optimism had set records in 2017.

Construction spend in 2017 was at an all-time high for the industry as the economic recovery was in full swing and the outlook for reductions in corporate tax rates allowed for investments. However, the construction market has been a little slower than other sectors to invest in and adopt innovative technologies that could improve automation. The outlook for 2018 had been favorable which could have spurred more of these investments, however, as almost any American from elementary school on up can tell you from watching, reading or listening to the news over the last several months: the issue of tariffs has heated up. Specific for the construction industry is the steel and aluminum tariff decision. According to American Iron and Steel, the Construction industry accounted for 43% of all steel shipments in 2017. This could have serious repercussions across the construction market and is causing concern from the construction and heavy equipment associations. If prices go up, profits go down.

So, what does this mean as we look out over the second half of 2018 and into 2019? So far, it's not dampening demand. According to economist Eli Lustgarten of ESL Consulting, as reported by Association of Equipment Manufacturers, the passage of a timely infrastructure bill would certainly help improve the long-term outlook for the construction sectors. Lustgarten said, “Policies matter, and an infrastructure bill would actually create a mini-boom,”

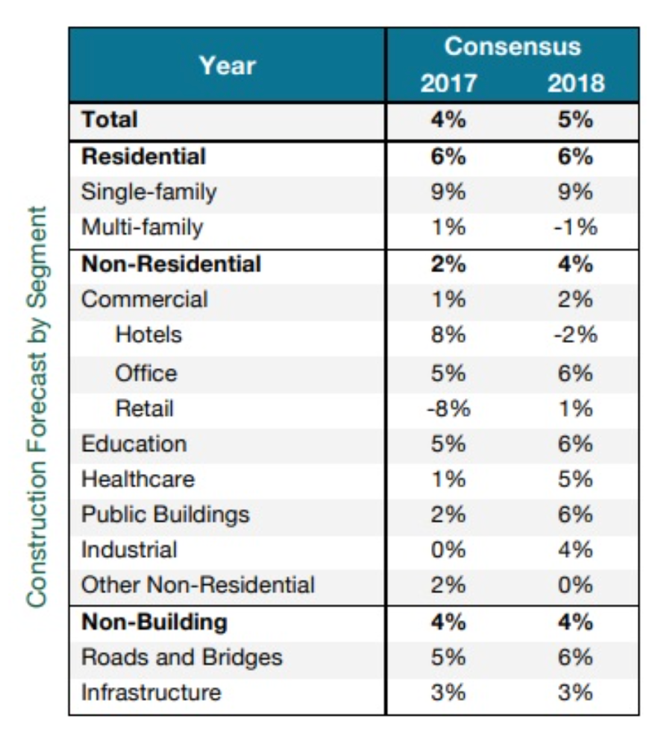

If we look deeper at the Construction forecast by segment, as forecasted by Oldcastle Building Solutions, we see Residential remains steady and in the lead at 6%.

If we look deeper at the Construction forecast by segment, as forecasted by Oldcastle Building Solutions, we see Residential remains steady and in the lead at 6%.

In the non-residential segment, we see that there is anticipated overall growth with public buildings, healthcare and retail leading the increase versus a decline in 2018 in hotels and other non-residential, including stadiums, after experiencing growth in 2016-2017.

The South and Mid-West anticipate gains in building, whereas the Northeast is expected to remain stable at 3% and the West will decrease from 8% in 2017 to 5% in 2018.

There is continued optimism across the industry. In a recently released report from FMI Corp., a leading provider of management consulting and investment banking services to the engineering and construction industry, construction spending in 2018 is on track mid-year to be up 6 percent over 2017. To keep up with this construction industry growth, contractors are expecting to increase their equipment rentals and purchases as well as grow fleet sizes. American Rental Assoc. forecasted a rise of 4.5 percent in US equipment rentals, to hit $51.5B by year end.

These are some of the trends that were highlighted in the Equipment Leasing & Finance report as well as other industry publications and reports:

The times they are a changin', and those who embrace some of these current trends will find themselves able to provide safer, smarter and more innovative structures that will keep you and your company in hot demand. Investing in these new technologies and practices, and having a partner like Ascentium to help with your financing needs, will allow you to build a strong future.

---

Ascentium Capital offers industrial strength financing to help you build your business. We offer fast, flexible financing options up to $1.5 million for nearly anything your construction business needs.

Contact us today to learn more and request a no obligation quote.

Leave a Reply

Leave a ReplyYour email address will not be published. Required fields are marked*