In the unpredictable world of business, financial stability and security are paramount. One of the key tools for safeguarding your business against unforeseen challenges is a well-structured Financial Risk Management Plan. In this comprehensive guide, we'll explore how to develop a strong financial risk management plan that ensures your business can weather storms, seize opportunities, and navigate complex financial landscapes.

The first step in crafting a robust plan is to identify and assess the specific financial risks your business faces. These risks can vary widely based on your industry, size, and market dynamics. Common financial risks include:

Once you've identified financial risks, establish a clear risk tolerance level. This defines the degree of risk your business is willing to accept in pursuit of its objectives. Your risk tolerance should align with your business' goals, financial capacity, and industry norms.

With an understanding of your financial risks and risk tolerance, it's time to develop risk mitigation strategies:

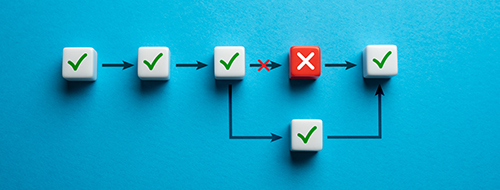

Develop contingency plans for potential financial crises. Your blueprints should outline specific actions to take if a financial risk materializes. Consider scenarios like economic downturns, supply chain disruptions, or unexpected legal issues. Having a well-defined plan in place can reduce panic and guide effective decision-making during turbulent times.

A financial risk management plan is not a one-time effort; it's an ongoing process. Regularly monitor your risk exposure, reassess risk tolerance, and update mitigation strategies as needed. Market conditions and business dynamics can change, so your risk management plan should evolve accordingly.

Consider seeking guidance from financial advisors, risk management specialists, and legal experts who can provide valuable insights and help tailor your risk management plan to your business's unique needs.

A strong financial risk management plan is a critical component of your business's long-term success. By assessing risks, setting risk tolerance, developing mitigation strategies, and preparing for contingencies, you can safeguard your business' financial health. Remember that effective risk management is not about avoiding all risks but about making informed decisions that align with your business goals and protect your financial stability. With a well-executed financial risk management plan, your business can thrive even in the face of uncertainty.

---

A strong relationship with a business financing lender like Ascentium Capital can help you mitigate risk. When your business needs access to cash or equipment financing, your relationship manager is just a phone call away.

Contact us today and get connected to your dedicated financing specialist.