Whenever business owners are applying for financing, their credit scores are examined. This may include your personal credit score as well as your business credit score. But how exactly do your personal and business credit scores impact your business financing options? Let’s find out.

Whether you’re starting a business or preparing for a recession, there are many instances where you’ll require additional funds. Financing can be a way to expand your inventory, bridge your payroll or upgrade your technology, among many other things.

A lender uses your credit score to determine how big of a risk you are and whether you can pay the money back on a regular schedule.

Lenders will see you as a bigger risk if you have a low credit score. They could offer financing with a high-interest rate or exclude you completely from securing a small business loan. If you have a high credit score, you can expect lower interest rates and a wider range of financing options.

Besides lenders, vendors and partners may use your credit score to decide whether to work with you or issue a line of credit. When it comes to cash flow for business operations, your credit score will be a decisive factor.

Personal Credit Score

A personal credit score is tied to your history with money. While there are many scoring systems, the Fair Isaac Corporation (FICO) score is most commonly used. Experian, TransUnion and Equifax are the three major credit bureaus that measure your personal credit score.

Credit reporting data varies by agency due to the different scoring algorithms they use. There are also customized FICO scoring methods for different types of lenders, such as small business loan lenders and home mortgage lenders. That means your FICO score will slightly fluctuate depending on the agency and the type of data used.

While there’s no universal method for calculating your credit score, the following factors are typically taken into account:

Business Credit Score

Once you start a business, you also have a business credit score. Like your personal credit score, it examines your financial health and history, but this time with your business. It’s used to illustrate a business’s financial strength and dependability, as well as its likelihood of making outstanding payments on time.

The major bureaus that calculate your business credit score are Experian, Equifax and Dun & Bradstreet. As with a personal credit history, there’s no universal scoring method. Each bureau has its own set of criteria for assigning a score and will gather data and information about your business's financial history.

The scores your business receives will determine your eligibility for future financing options. Here are some general criteria that affect your business credit score:

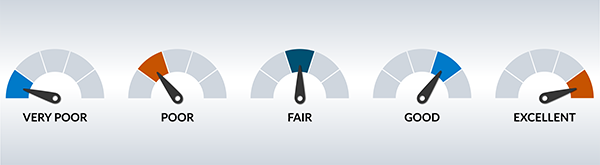

Personal Credit Scoring

Scores can range from 300 to 850. While your scores will differ depending on the credit bureau, they’ll usually be similar to each other. Here’s a general guide of what each numerical scale says about your financial reliability and health, and how it impacts your business financing options:

Business Credit Scoring

The numerical scale for business scores ranges from zero to 100. Typically, many lenders want a business score of at least 75. Scores in the higher range will show you pay your business bills on time, have a longer-established business and handle your finances responsibly.

---

No matter your credit score, you should know all the options available to you. At Ascentium Capital, we specialize in helping small and mid-sized business owners secure the financing they need.

To learn about our flexible financing options and get a free quote, send us a message today.