Healthcare technology is a frontier which may transform all aspects of medical care. Patients, providers, payers and institutions are all seeing changes—and improvements—in type and quality of care. Hospitals are improving the patient experience through a range of technologies like data analytics and remote monitoring. Though there is still a lot of frontier to explore, the current landscape may be pointing to truly transformational achievements in the not-too-distant future.

The Internet of Things (IoT) has permeated virtually every business sector. In the healthcare arena, the IoT plays a role along the continuum from healthcare institution to healthcare provider to patient. The patient end of the continuum comprises the wearables market (below). According to a 2017 survey of providers and payers, the use of IoT in organizational operations enables significant efficiency improvements and helps reduce waste. It also relates to patients in new ways through wellness and prevention as well as remote monitoring, which allows providers to track patient status in real time while at home or elsewhere.

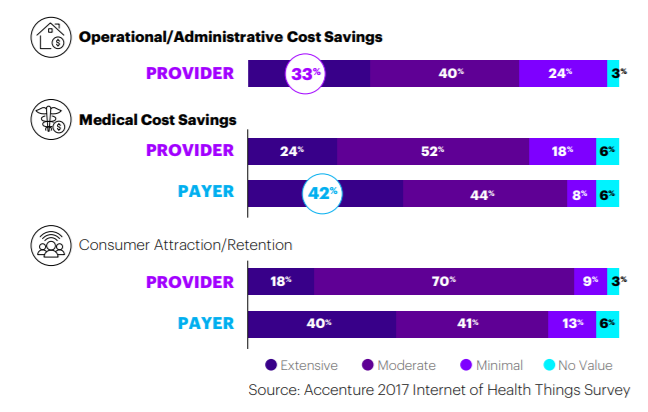

Survey participants reported significant business value from IoT (Figure 1). The IoT healthcare market is expected to reach $477.9 billion by 2025. In the development of solutions for end users like physicians, hospitals, clinics, surgery centers and research facilities, major players include large technology enterprises including Cisco Systems, IBM and Microsoft.

Figure 1. Business value of IoT as reported by providers and payers.

The healthcare wearables market spans a wide variety of devices. The most well-known in the consumer space are wellness management devices like Fitbit, Apple Watch and the Garmin line of smart watches. These units gather data related to health, exercise and fitness like step counts, caloric intake, heart rate and sleep patterns.

New generations of these devices are offering additional features. Silicon Valley firms have historically avoided development of consumer device features requiring FDA oversight, which might be one reason that this market sector has moved more slowly than once expected. Consumer technology companies now appear willing to make the process adaptations and personnel acquisitions required to work with the agency. Apple was the first to cross into the regulated healthcare space in its consumer products with the Series 4 Apple Watch which incorporates an ECG system into its functionality that received clearance from the FDA through the agency's de novo process.

A range of wearables that integrate into the IoT are currently in use by hospitals and healthcare providers. Examples include:

The market for healthcare wearables is forecast to reach $60B by 2023.

Artificial intelligence (AI) and machine learning have gained a lot of traction in the healthcare sector. The global AI healthcare market is estimated to reach $22.8B by 2023, fueled by the ability of AI to augment provider capabilities to improve results and an increase in the use of AI's fine precision in diagnosis and surgery. These are notable examples of the ways in which AI is impacting healthcare:

Perhaps the most significant contribution of AI is in the rise of “precision medicine,” which relies on deep learning super computers. Large volumes of data collected through the use of other healthcare technologies (e.g., patient sensors and genome sequencing) are analyzed through computing algorithms, allowing providers to finely-tune and tailor treatment on an individual level.

AI-powered robotics are being used to enhance surgery team capabilities by collecting comprehensive information and providing analytics to improve future surgeries. A miniature mobile robot under a surgeon's control can aid in heart surgery by entering the chest through an incision, attaching to the appropriate place on the heart and executing the actions needed for therapy with great precision.

Robotics are making a difference in another key area of healthcare. Drones are being used to transport samples and equipment in urgent or emergency situations. For example, drones delivered medical supplies to hard-to-reach areas of Puerto Rico after Hurricane Maria hit the island in 2018.

Scientists and tech companies have come up with a wide array of uses for 3D printing in healthcare. While much of the most transformational uses, including 3D-printed organs and blood vessels are still in the research stage, several are currently in practice:

Market forecasts vary widely, from $1.97B by 2023 to $23.9B by 2022. The large difference is numbers may reflect a high degree of uncertainty about the applications of this technology and the ability to get regulatory approval for them.

The healthcare technology sector is changing as companies in the sector continue to innovate. Healthcare providers, hospitals and other care units and consumers are becoming more and more digitally connected as the delivery of medical services evolves and patients take a more proactive role in the management and treatment of their health issues.

The changes brought about the healthcare technology could be slowed due to regulatory caution, ethical concerns and data privacy issues. Questions that have either not been addressed or sufficiently answered include:

Tech companies that are just entering the healthcare space must adapt their processes and workflows to FDA's procedures and requirements. This could slow progress in some instances as the firms ramp up and make the necessary organizational changes.

On the other side of the table, the FDA has voiced caution in some areas of healthcare tech. As an example, in February 2019 the agency released a reminder that robot-assisted prevention or treatment of cancer is not approved. More specifically, the FDA stated that it “has become aware of the increasing use of Robotically-Assisted Surgical Devices (RASD) for the prevention of cancer and treatment of patients with cancer. It is important for health care providers and patients to understand that the FDA has not granted marketing authorization to any RASD system specifically for the prevention or treatment of cancer.”

Further work must be done to answer the types of questions noted here and to meet FDA requirements and standards in order to make the kind of progress in quality of care and improvement of medical science that providers and consumers hope for from the healthcare technology sector.

---

Ascentium Capital supports your medical or dental practices by providing financing for healthcare technology upgrades and improvements. Take advantage of our flexible equipment financing and working capital loans to grow your practice today.

Fill out this quick form and a member of our healthcare technology financing team will contact you!

The mention of or links to third-party information, services, products, or providers does not imply endorsement or support by Ascentium Capital. Individual research should be done before use of any product, process or service mentioned.

Leave a Reply

Leave a ReplyYour email address will not be published. Required fields are marked*