The U.S. renewable energy industry continues to grow despite federal legislation uncertainties and implementation of new import tariffs.

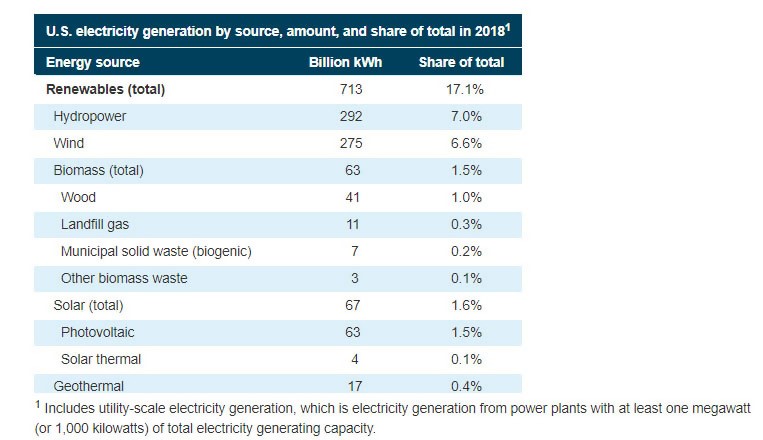

Renewable energy sources accounted for approximately 17% of total electricity generation in 2018. These sources included hydropower (7%), wind (6.6%), biomass (1.5%), solar (1.6%) and geothermal (0.4%). The global market is expected to realize around 5% compound annual growth rate to a size of $2B by 2025.

Source: https://www.eia.gov/tools/faqs/faq.php?id=427&t=3

Industry drivers in 2018 included improvements in battery storage capabilities, lowered cost of wind and solar generation and the continued improvement in utility operators’ ability to integrate renewable energy into the grid. Another strong driver is market demand for alternative power by both corporations and consumers.

A key driver, or possibly obstacle, for growth in 2019 and beyond is government policy. In the solar arena, tax credits are phasing down from 30% to 26% in 2020, which may affect corporate and residential demand. The outlook for growth is positive for renewable energy providers as consumers and builders focus on launching projects this year. A potential obstacle to solar generation market growth is the 30% import tariffs on solar cells, steel, aluminum and inverters. This may have the biggest impact on utility-scale (one megawatt or more of generating capacity) projects which may be abandoned at the planning stage, cancelled or deferred.

State and local government policies are expected to continue to promote growth in renewable energy projects and may offset obstacles posed by federal policy. For twenty years, around 50% of the development of wind and solar generation was driven by state mandate, in particular renewable portfolio standards (RPS) that specify a percentage of the state’s electricity that is to come from renewable sources. Around half the states with RPS objectives are set to achieve them by 2021, and several states either have increased their RPS targets or are considering an increase. Hawaii and California have launched programs to reach 100% renewable-source electricity by 2045 and others are considering this goal as well. This continued attention on renewable energy at the state level is a contributor to industry growth. Municipalities are also influencing the industry. By the end of 2018, over 200 communities across the country had established objectives for achieving 100% renewable-sourced electric supply by 2035.

Wind-driven generation is being supported by favorable state and federal policies. Several states along the Eastern Seaboard have established goals pertaining to wind generation facilities and are working to support development of offshore wind farms. The U.S. Department of the Interior Bureau of Ocean Energy Management announced three significant activities in the second quarter of 2018:

These announcements, coupled with positive state and federal policies pertaining to wind-driven generation, are favorable indicators of growth in this part of the renewable energy sector.

Battery storage has historically been a stumbling block in the progress of the renewable energy industry, primarily due to prohibitive costs. This is changing as falling prices coupled with benefits being realized through technologies like blockchain and artificial intelligence are quickly making battery storage economically viable. Providers that are bundling generation and storage into single solutions are becoming competitive with traditional offerings among providers.

Government policies are favorable to battery storage advancements. Federal Energy Regulatory Commission Order 841, finalized early in 2018, facilitated use of electric storage in electric services markets by eliminating a previous obstacle to the uptake of battery storage in large-scale systems. Many states are creating new rate structures that favor solar/storage combination solutions. These activities may aid improvement in battery storage solutions and foster the growth of this area of the industry, which in turn will have a positive influence in larger industry growth.

Corporate procurement of electricity from renewable energy sources continues to increase as more firms establish sustainability objectives and as procurement options rise. Some states have approved or proposed “green tariffs” that encourage corporate renewable energy procurement. Tech giants Apple and Google are now 100% powered by renewables. Joint procurements by large enterprises like the mega-deal announced by Apple, Akamai, Etsy and Swiss Re in 2018 may be a significant spur to industry growth. Microsoft is a significant influencer in the corporate procurement of renewable energy, growing its footprint to 1.2 gigawatts in the U.S. and elsewhere in the world. The company has partnered with other large enterprises to create ways to mitigate risk in renewables procurement in the corporate space, which could generate more activity in this space.

Oil and gas industry interest in renewable energy has increased, due in great part to falling renewable costs and the strategic desire to diversify. Several companies have increased renewable investing in the last two years, including investment in wind and solar energy projects and companies. For example, Total S.A. owns 56% of SunPower, a global solar cell and solar panel manufacturer, Royal Dutch Shell has acquired 44% ownership of solar developer Silicon Ranch, and BP has a 43% stake in solar company Lightsource BP. Chevron has a diverse renewable investment portfolio with equity stakes in wind, geothermal and solar generation companies. Though these investments are a tiny fraction of each enterprise's assets and their primary focus remains on fossil fuels, the activities may be a barometer showing future growth stimulated by the petrochemical industry.

Technology innovations are likely to have a positive impact throughout the renewable energy industry. Unlike previous renewable sector innovations, the new generation are digital, allowing the industry to leverage data and platform analytics to craft new business and revenue models. Analytics-based platforms can improve optimization of grid assets, and they can partner with utilities to provide customized services to customers. For example, providers like Sunrun operate software platforms that allow customers to manage solar, storage and home energy usage.

Digital tools for forecasting return on smart home investments, renewable energy output and grid integration results have proven useful. New applications promise to add further value in areas like peer-to-peer trading, use of blockchain technologies as payment vehicles and tracking renewable energy certificates.

Falling renewable energy costs, strong demand from corporate and individual consumers, favorable governmental policies and innovative technologies are components for industry growth in 2019 and beyond. Increasing customer demand for renewable energy across almost all market segments continues to expand opportunities. Many states, cities, communities and businesses have established ambitious sustainability goals which are driving growth in the industry. Renewed interest from global oil and gas enterprises and developing digital solutions are further growth contributors. These factors combine into an equation for growth and innovation in the near, medium and long term.

---

Ascentium Capital wants to support your sustainability projects. Our corporate renewable energy financing programs are flexible and can be customized to suit your unique business needs.

Fill out this quick form and your finance manager will provide a no obligation quote.

The mention of or links to third-party information, services, products, or providers does not imply endorsement or support by Ascentium Capital. Individual research should be done before use of any product, process or service mentioned.