The Equipment Financing and Leasing Industry is a $1 trillion-dollar industry, with approximately 60% of leased and purchased equipment in the United States funded by the equipment financing and leasing industry.

Over the past few years, there has been significant growth in this financing sector. Up-trends are expected to continue in 2019, though 2018 was considered a banner year with greater advancement than is expected to be seen in 2019.

2018 was a good year for the equipment financing and leasing industry with healthy growth of 7.9%. In the first two quarters of 2018, the industry growth was driven by favorable changes in taxes and an upswing in the U.S. economy. However, in the third quarter, this trend began to decline, leading to a slower growth period that is expected to continue in 2019.

The Equipment Leasing & Finance Association still expects to see growth of 4.1% in 2019 and believe things will remain favorable for the equipment finance industry through this year. To get a better idea of the predictions for 2019, it's helpful to break it down by equipment industries.

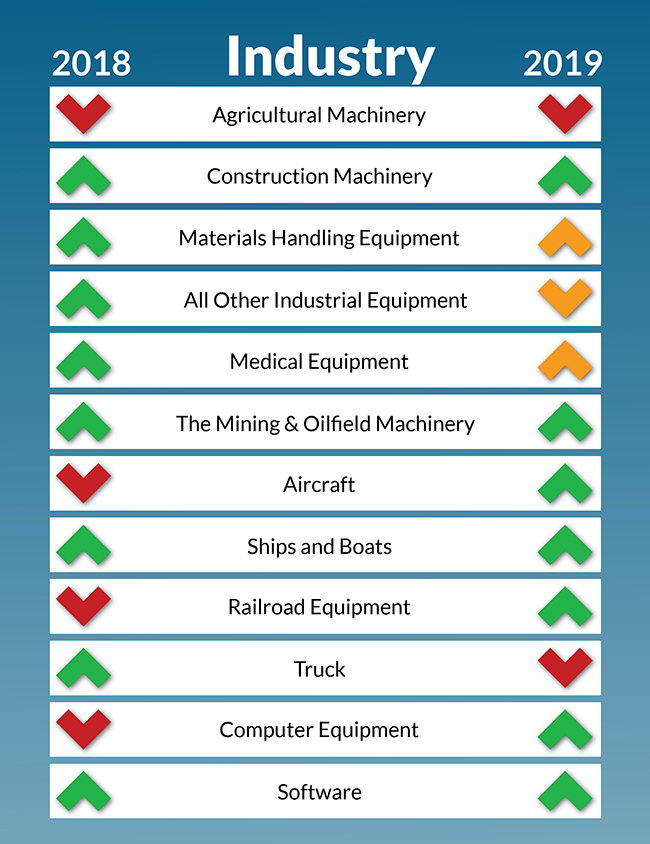

Over the course of 2018, the Equipment Leasing & Finance Foundation tracked twelve equipment verticals. Below are the predictions for growth or decline for 2019 by the Equipment Leasing and Financing Foundation:

Knowing what will drive growth in the equipment financing and leasing industry is as essential as knowing its challenges.

Leasing is at the Forefront of Equipment Financing

In the private sector, leasing is the preferred financing option in multiple industries. Leasing accounts for 48% of payment methods for equipment and software, while lines of credit and secured account for 9% and 8% respectively.

Strong Labor Force and Healthy Consumer Spending

Throughout 2018, growth in the equipment financing and leasing industry was bolstered by a strong labor market and healthy consumer spending.

According to the Equipment Leasing & Finance Foundation, 213,000 jobs were added in the United States each month in 2018 from January to October. Wage growth accelerated and the prime-age labor participation has risen. While job gains may moderate as the labor market tightens, it’s still expected to remain healthy throughout 2019.

Additionally, consumer spending is one of the biggest drivers in recent economic growth. Consumer confidence is high, probably partially due to tax cuts and the improved labor market. Data suggests that this trend should continue through 2019.

Industry 4.0, Artificial Intelligence and Smart Technology

New technologies like artificial intelligence and machine learning will greatly change and challenge the equipment financing and leasing industry.

These changes are an opportunity for growth in this industry, but it will also force businesses to adjust to meet the needs of new technologies.

There are several challenges to be aware of for 2019. The equipment finance industry should continue to grow, but there are some obstacles expected to effect growth in 2019.

The Cost of Trade Tariffs

One item that many people share as a concern is potential trade frictions that may constrain U.S. exports. The new trade tariffs may cause global consumers to tighten their spending.

The current administration's new trade tariffs may also affect the cost of equipment, which may, in turn, affect public and private buying power.

Recently, John Crum from Equipment Finance Advisor studied the impact of steel and aluminum tariffs on the construction industry. He interviewed people in the construction industry to see what kind of financial difference the tariffs may have made on their business.

While many people agreed that the cost of materials rose, there was also a consensus that the cost of equipment had remained stable. It’s unknown if this trend will continue in 2019, or if the cost of material (steel making up about 10% of the overall cost of equipment) will be passed on to consumers in 2019.

Concerns Over Government and Political Issues

Another concern industry experts have is decreased government spending as well as government division. In response to the recent NFIB Small Business Optimism Index update in January, NFIB President and CEO Juanita D. Duggan said, “One thing small businesses make clear to us is their dislike for uncertainty, and while they are continuing to create jobs and increase compensation at a frenetic pace, the political climate is affecting how they view the future.”

However, Valerie Gerard of Monitor Daily believes that the new Democratic-controlled House of Representatives may translate to renewed infrastructure spending and therefore lead to growth opportunities for equipment financing.

Additional Concerns

Other possible challenges in 2019 include rising interest rates, uncertainty in the oil and mining industries, and housing sector weakness.

Reportedly, in mid-2019, non-depository fintechs are to receive fintech charters from the Office of the Comptroller of the Currency. These charters will give fintechs the ability to operate nationwide instead of under multiple state regulations. It's unknown at this time how this will impact the financial sector.

Prospects remain hopeful for 2019 in the equipment financing and leasing industry. While some headwinds are expected such as challenges in international trade, uncertainty in housing, mining, and oil industries, rising interest rates, and division in government, there is still a confident expectation of growth in 2019.

Equipment financing and leasing firms, as well as equipment and software manufacturers, who want to continue to succeed in 2019 and beyond will benefit from adapting to the changing technology needs of consumers.

The United States' economy has had a strong year in 2018 and should continue into 2019 with healthy consumer spending and a stable labor force.

***

Ascentium Capital provides equipment financing, leasing and small business loans to businesses nationwide. Let us help your company achieve and exceed your growth targets through flexible financing structured to your unique needs.

Contact us today for a no-obligation quote.