As we go about our lives, we have our financial discipline monitored by the three big consumer bureaus – Equifax®, TransUnion®, and Experian™ – and your FICO score is built using this consumer bureau data. Even the best of us have experienced that moment of fear when we hear that we need to have our credit pulled . . . and we don't know where our number will land. Not all credit pulls are created equal, however; there are important distinctions between hard and soft credit pulls, or credit checks, and the Fair Credit Reporting Act dictates when and why credit reports may be pulled. The two forms of credit inquiries have different effects on your credit report and FICO credit score across the reporting agencies.

Hard credit pulls, or inquiries, are probably what you think of when you are told someone needs to run a credit check for a loan application. These are credit inquiries that you have voluntarily agreed to, to help a lender determine your credit worthiness.

Hard pulls do have an impact on your credit score, so you want to think about how you approach the number of credit inquiries you allow—each credit card you open or line of credit you apply for will require one. If you have multiple hard inquiries over a brief period, you could appear to be a high-risk borrower and that can impact the interest rates you pay or you may get denied access to credit completely. If you're shopping for a high-ticket item like a mortgage however, you'll get high marks for approaching these decisions in a financially responsible manner. Your FICO score considers all inquiries within a 45-day period for a mortgage, an auto loan or a student loan as one single credit inquiry.

Soft credit pulls are gentler checks of your credit report. They are typically done without your express consent, so you may be surprised when looking at your credit report and seeing these inquiries. But fear not, they do not negatively impact your credit score.

Under the Fair and Accurate Credit Transactions Act of 2003 (FACTA), people can check their own credit score directly through one of the credit bureaus for free once per year. Since then, other credit services such as Credit Karma, have launched to give consumers the ability to stay on top of their credit score. These checks of your own credit are one of the most common soft pull inquiries. You've also likely experienced a soft pull of your credit if you've ever received a pre-screened offer of credit.

Hard Inquiries

Soft Inquiries

Understanding how credit inquiries may or may not affect your FICO score is very important and should inform your decisions – especially if trying to raise your score. The information about inquiries that can be factored into your FICO score includes:

Large numbers of inquiries equate to greater risk in a lender's eyes: people with six inquiries or more on their credit reports are eight times more likely to declare bankruptcy than people with no inquiries on their reports.

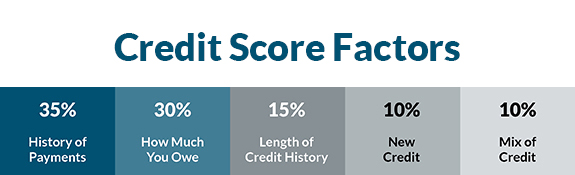

Knowing your credit score is important, but there was a time when many of us not only didn't know our score but were unaware of how the credit reporting bureaus and FICO formulated the scoring. Taking an active role in managing your credit score by checking your credit reports for accuracy and avoid identity theft, will set you up for financial success. And the next occasion a lender asks for your permission to pull your credit, you will already know what they are going to find.

---

Ascentium Capital makes credit decisions based on the full strength of the business, not just credit scores. Our fast, flexible financing programs help businesses acquire the technology and equipment they need to succeed.

To learn more about Ascentium Capital's business loans, fill out this quick form to contact us today.

The mention of or links to third-party information, services, products, or providers does not imply endorsement or support by Ascentium Capital. Individual research should be done before use of any product, process or service mentioned.

Leave a Reply

Leave a ReplyYour email address will not be published. Required fields are marked*