*Updated June 2022

One of the most critical decisions a franchise owner can make, is selecting the method of funding for their business. Below are common franchisee needs that typically require financing:

Franchisees know how important it is to have clean, inviting establishments, but this can be quite costly. It can be very expensive to remodel and upgrade furniture and signage. However, a re-imaging program is an investment that can yield a positive return.

It is customary for franchisors to make periodic updates to their brand and require specific updates. Franchisees typically have a designated time frame to get them implemented. Even with ample cash flow, it can still be difficult to pay for. Thankfully, there are many options for securing an affordable financing program that is structured around budget requirements.

Franchise maintenance is more than just keeping your furniture, fixtures, and windows clean, or having a landscaper tidy up your commercial grounds. This is where franchise financing comes into play, especially if you own more than one property. Explore your financing options to ensure your selection is tailored to your business needs and maximizing the return on your investment. Let’s investigate financing options that best meets your needs.

Potential lenders or investors will need to get a clear picture of your financial health and performance and understand how you plan to use the money. Develop a business plan that examines all aspects of your business and includes the following:

With many funding options available for franchise operators, it is important to understand pros and cons before committing to a financing plan of action. We will examine several funding sources and cover the key points to consider. The financing you select can have a substantial impact on the overall health and success of your business. You should always consult your accountant or tax advisor before making a final decision.

Equity financing requires giving up a portion of ownership and potentially some control of your business in exchange for the funds needed. Individuals and organizations that provide equity financing become a business partner. The more capital you need, the more ownership and/or control they will likely want in exchange. The equity investor will have a vested interest in your business succeeding and may want to play an active role in business decisions. So, when considering an equity investor, seek one that brings sound business judgement and expertise into the partnership, in addition to the cash.

This is a common financing option. Debt financing involves a loan or line of credit where you borrow a specific amount and agree to pay it back over a specific term and at a specific interest rate. Many business owners have taken out a home mortgage or finance a vehicle. These assets may be required as collateral for the loan, but you continue to own and use those assets as part of ongoing business operations. However, if you should land in a situation where you are unable to repay the loan, these assets will be at risk.

Many people are reluctant to take on debt but funding your business with debt means you don’t have to give up a portion of ownership or control. This is a compelling reason for debt financing. When the loan is paid off, the process is complete.

Another option for franchise financing is a local bank where you can discuss your business plans and capital needs with a commercial loan officer. Since many banks are more comfortable making loans to traditional small businesses, such as retailers, manufactures, and construction companies with tangible assets that can be used as collateral, some franchisees may find it difficult to find bank financing that meets their needs. The lack of control that a franchisee typically has over the property or due to a franchisor agreement, can be a red flag to banks, therefore it’s important to have copies of all of the necessary agreements when meeting with your loan officer.

Small Business Administration (SBA) loans are not made by a federal agency. They are issued by traditional banks with repayment guaranteed by the SBA. This guarantee is viewed by banks as a reduction of risk. One constraint with SBA loans is turnaround time. There is a great deal of time involved with a lot of paperwork and lending limits. Since both the bank and the SBA have a stake in the transaction, they require more documentation, and the fees may be substantial. Most often, the process will take weeks or months.

The following are the types of SBA loans banks may offer:

Each loan has a set of terms and restrictions. SBA loans can be a useful financial tool to meet your business needs due to its flexibility regarding how funds can be used: business acquisition, real estate, inventory, contract payoff, franchise fees, renovation, equipment and other items. SBA loans typically require lower down payments and offer longer repayment options than conventional business loans, which enables business owners to preserve cash as the business grows.

Non-traditional lenders, like private-independent lenders, do not have the same regulations as traditional banks. They typically offer financial products tailored to the specific needs of a small business, with minimal paperwork and often faster turnaround time. Whether the objective is to purchase a franchise, add another franchise location, or renovate an existing location, there are finance products available to meet a variety of business needs, both short and long term.

Below are common finance offerings:

Traditional and non-traditional lenders generally offer equipment finance and lease agreements. This type of financing can be used for equipment, technology, software, furniture, fixtures and more. If you buy equipment outright, you deplete capital immediately. One way to avoid this is by financing your equipment. This is popular option that enables you to acquire nearly everything your franchise needs with affordable monthly payments. This helps you preserve cash flow. Applying for financing up to $500,000 usually requires completing a simple document and approval can often occur within hours. Financing larger amounts will require financial statements and other documentation.

Finance agreements and lease agreements also help franchisees avoid equipment obsolescence. The fastest growing franchises continually face pressure to stay ahead of competition by outfitting their franchise with the latest advances in equipment, software and technology. Certain finance contracts make upgrading these items extremely simple while giving your franchise a competitive edge. This isn't the case when you buy equipment –you are stuck with it unless you can sell it, and residual values on used equipment are low.

Franchise owners know that having a sufficient amount of working capital is vital to success. It will be extremely beneficial should you experience a slow sales period or incur unexpected expenses. Today, many franchise owners are having a difficult time finding solutions to address these cash flow needs.

Get an influx of cash to grow your business or take advantage of an unexpected opportunity with a working capital loan:

Working capital loans may be an excellent alternative to traditional business loans. Most lenders offer a simple application process and quick funding, which are critical when your business is in a bind.

This financing is more commonly utilized for short term liquidity needs. The loans are generally structured with a fixed payment schedule and typically have a term ranging from 12-36 months. Like many financial products, credit worthiness may also depend on the strength of the franchisee as well as the brand concept.

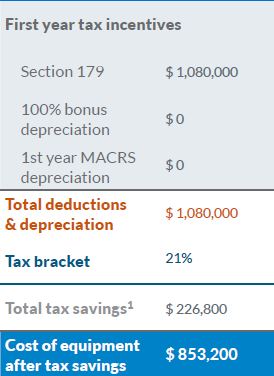

Last but certainly not least, you will want to check to see if your business purchases and the finance product are eligible for the 2022 Section 179 tax deduction. Many companies prefer to accelerate depreciation during the first year versus over several years. With Section 179 in 2022, you may write-off up to $1.08 million on eligible business assets, lowering the cost of equipment acquisition. This incentive is intended for small businesses, so the benefits are phased out on purchases of $2.7 million or greater. Check out this 2022 Section 179 Calculator that can show your potential tax savings. Make sure you consult with your accountant to ensure the purchases are eligible for the Section 179 tax deduction.

Bonus Depreciation = More Tax Savings

Bonus depreciation covers both used and new qualifying equipment. Bonus Depreciation is useful when spending more than the Section 179 amount (currently $2.7 million). Make sure to do your due diligence to ensure you are maximizing the benefits of Section 179.

---

Utilizing financing to grow and improve your franchise business can make your dreams a reality. Once you have explored your financing options, you need to find the right lender that can provide fast, flexible financing options that fit your overall business goals. If you are thinking an equipment financing or a working capital loan is the best choice - Ascentium Capital can help.

Review Ascentium's customized franchise financing programs to learn how we can help take your business to the next level.

Want more information? Click here to request a copy of our free Non-Traditional Financing Brochure.

Leave a Reply

Leave a ReplyYour email address will not be published. Required fields are marked*