Small to Medium-sized Businesses (SMB) are in an interesting time of innovation and technology, but can face a myriad of challenges to keep up with growth and address the changing needs of their customers. Businesses are finding new ways to overcome obstacles to invest in their company’s growth, and equipment financing and leasing options are an area that growing businesses are exploring.

When SMBs decide to invest in their companies, they either make the decision to re-invest profits or turn to their local bank for credit. Many times capital lending may be difficult even with the business’ own local bank. These banks are not always equipped to structure and deliver loans in a timely fashion. This is why many businesses are turning toward working with an alternative financing partner who can help them meet their needs quickly and easily so they can concentrate on growing their business.

The 2015 State of Small Business Report showed feelings of optimism and faith in the US economy. This is very good news for the SMB market and that optimism is reflected in their investments. According to The Equipment Leasing and Finance Association, the U.S. equipment finance market grew to over $900 billion in 2014.

As more companies consider working with an alternative financing platform to satisfy their business needs, it is important to understand the business advantages of leasing and financing. Benefits include:

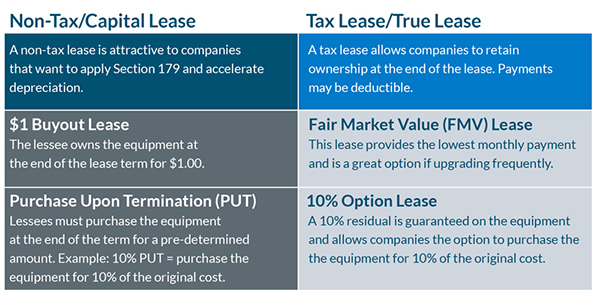

Businesses can finance a whole host of items to fuel their growth and remain competitive in today’s business environment. By exploring financing vehicles for new or used equipment, business owners can find flexible leasing solutions with terms of up to 84 months, and 100% financing up to $1.5 million. The type of lease a company chooses may be dependent on if they want to retain ownership of the equipment at the end of the lease or not, if they want their payments tax deductible or apply Section 179 to accelerate depreciation, or many other financial decisions that would help structure the right lease option for their company.

Ascentium Capital’s consultative approach to commercial financing helps companies create a financial structure that will match your cash flow. For more information on flexible financing options, contact us.